Biomedical

The East Bay is a world renowned hub for biomedical innovation, with more than 880 life science companies and billions of dollars in grant funding annually. The region's talented and skilled workforce, cutting-edge R&D capabilities, world-class universities and national laboratories foster an environment that encourages technological innovation and growth.

Why the East Bay?

Innovative Culture

- Cutting-edge research

- Tech transfer via spin-outs and licensing

- Growth opportunities from start to scale

- Global biomedical anchor companies in the region

- Industry cluster effect

- Supportive economic development policies

Access to Talent

- Highly-educated and diverse workforce and career pathways

- Regional companies, hospitals, universities, and national laboratories

- “Spill-over” effects in the form of shared talent, suppliers, and ideas

- Biomedical-specific support infrastructure

- Professional networking and collaboration

- Inclusive communities and quality of life in Bay Area

INDUSTRY SUMMARY

Description

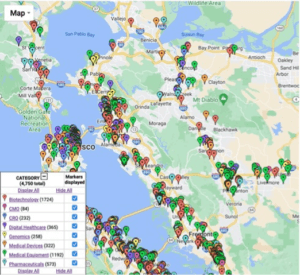

The East Bay is home to over 880 biomedical companies ranging from hundreds of small startups to large multinational corporations. Alameda County has the fourth-highest number of biomedical companies in the State of California. View the interactive map with company locations>

The East Bay biomedical industry includes biotechnology, pharmaceuticals, medical devices, medical equipment, genomics, and digital healthcare. The following describes the biomedical sectors:

Biotechnology

The use of living organisms to produce products, including drugs.

Pharmaceuticals

Chemical compounds manufactured for use as medicinal drugs.

Medical Devices

An instrument, apparatus, implement, implant, in vitro reagent, or other similar article inserted into the body to improve health.

Medical Equipment

Products for use by health care providers, including diagnostic, treatment, life-support, and lab equipment.

Genomics

Studying a person’s genes, including interactions of those genes with each other and with the person’s environment as part of the person’s healthcare.

Digital Healthcare

Electronically connecting the points of care so that health information can be shared securely, including mobile health, health information technology, wearable devices, telehealth and telemedicine, and personalized medicine.

The biomedical industry is characterized by its propensity to spatially cluster. Fremont is the East Bay city with the most biomedical companies and employment in the East Bay in 2023. Fremont has the most companies (131) and by far the most employees (>8,000). A second significant biomedical industry location is Berkeley-Emeryville. Berkeley added the most companies and the most employees between 2013 and 2023. Combined with nearby Emeryville, there were 165 companies and 6,658 employees in 2023. Pleasanton is a third biomedical cluster in the East Bay. Pleasanton has the second most biomedical employees in the region (4,843) and added the second-most employees between 2013 and 2023. A couple of additional cities have notable numbers of biomedical companies – Newark with 30 and Richmond with 29 companies.

“Retaining our biomedical manufacturing in the East Bay gives us the ability to be flexible in facing new challenges, to adjust the company’s strategy, and to develop new ways of competing with service, technology, and even marketing.”

880

Biomedical companies in the region

Key Players

Biomedical companies make manufacturing a strategic component for the region enabling flexibility to respond to opportunities by customizing products to meet customers’ changing needs or replacing low-margin commodities with differentiated high-margin products

Of the East Bay’s more than 880 biomedical companies, the vast majority are small startups. However there are numerous major companies such as Bayer, Novartis, Roche, Thermo Fisher Scientific, Carl Zeiss, Abbott, Baxter, and Agilent. Early momentum from the location of these global biomedical leaders helped put the East Bay on the biomedical map. Biomedical manufacturing is an essential piece of these companies’ value chain and separating it from the rest of the company would handicap responsiveness and innovation. These companies use their manufacturing as part of an integrated system that allows them to be more agile to adjust to changes in customer demand, technological innovation, and competitive conditions.

The biomedical industry has thrived in the East Bay due to its access to world-leading research at regional companies, hospitals, universities, and national laboratories. However, the region’s success has also been predicated on the availability of high-quality resources such as technology transfer services, a wide variety of suppliers, investment funding, laboratory and manufacturing space, highly trained workers, sophisticated customers, supportive economic development policy, and intermediary support to connect firms to regional resources.

The gravitation force of industry agglomeration has been a driver for growth of the biomedical industry in the East Bay. As more companies moved to the region, it caught the attention of other companies that then considered the area. Industry agglomeration is often credited with ‘spill-over’ effects in the form of shared talent, suppliers, and ideas.

In addition, a big part of industry dynamics is the entry/exit movements of the companies. Over the last decade, over 150 companies went out of business, were acquired and absorbed, or moved out of the East Bay. Most of these companies that exited went out of business were medical equipment and biotechnology companies. Forty-five companies were acquired and absorbed during this ten-year period, and more than a dozen companies moved out of the Bay Area entirely.

“We do a lot of product development and having manufacturing integrated with other activities enables incremental improvements in quality until we get it right.”

Number of Jobs

The high growth rate of the biomedical industry is partly attributed to the availability of bachelors, masters, and doctorate level science and engineering talent, which has been in strong supply in the East Bay.

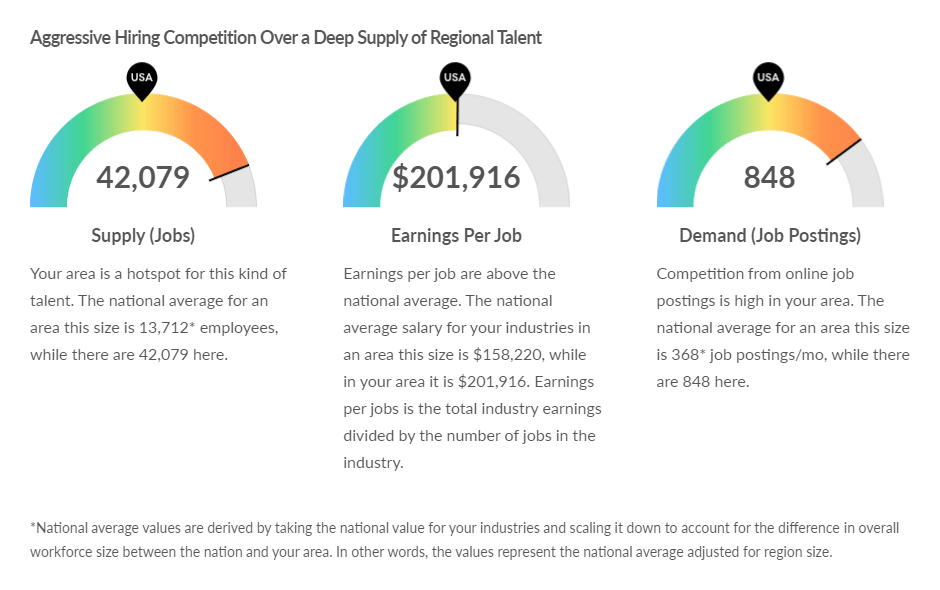

In 2022, there were approximately 42,000 biomedical jobs. Over a ten-year period, the industry experienced remarkable job growth of 48%. Nearly all subsectors experienced increases except in pharmaceuticals and a couple specialized equipment manufacturing (i.e., glass product and dental equipment). The medical equipment sector remains the largest biomedical employer in the East Bay with over 11,000 employees, and this sector continues to add new positions. Advancements in biotechnology, genomics, and digital healthcare will continue to drive job growth.

NAICS codes used in this analysis: 325411, 325412, 325413, 325414, 327215, 334510, 334516, 334517, 339112, 339113, 339114, 339115, 541714, 541715, 811210

Hiring Competition in Biomedical Industry, Alameda and Contra Costa Counties, Lightcast, 2023

Hiring Competition in Biomedical Industry, Alameda and Contra Costa Counties, Lightcast, 2023The market is forecasted to grow at a moderate rate, with the prediction of a mild recession.

The competitive job market will respond with higher attrition rates which will force companies to be creative in “doing old things in new ways” as it comes to talent retention and attraction.

42,000+

Biomedical employees

Trends and Driving Force

The East Bay has become an optimal location for biomedical companies because of the presence of important resources necessary for their evolution, growth, and maturity.

Although the overall number of biomedical companies in the East Bay has increased in the last decade, the number of companies fell in medical devices, increased slightly in medical equipment, while pharmaceutical companies remained stable. Maturing companies in these three sectors have resource needs that are the most difficult to locate in the San Francisco Bay Area, including industrial space for scaling up production, and lower skill and wage positions for equipment operation and device and equipment assembly.

The two newest and most emerging sectors of the biomedical industry – digital healthcare and genomics – need non-specialized office space and engineers and information technology specialists, both of which are in high supply in the East Bay. The continuing leadership of the medical equipment sector is at least partially due to the maturity and market foothold of the largest and leading medical equipment companies in the East Bay. Medical equipment and devices and pharmaceutical companies will continue to play important roles in the East Bay because companies in these sectors have deep roots in the region, employ a significant number of people, and are likely to grow in the future.

In addition, the biomedical industry reaches beyond health care. Biomedical innovation often advances companies in other industries. For example, biotechnology advances are leading to cleantech products such as recyclable, sustainable materials, or food and beverage products such as lab-grown meats.

“Manufacturing is an essential piece of our value chain and separating it from the rest of the company would handicap our responsiveness and innovation.”

Challenges and Opportunities

In Spring 2023, East Bay EDA convened focus groups and interviews with industry leaders who shared why they’ve chosen to locate and invest in the East Bay, as well the challenges and opportunities facing the industry.

The key challenges mentioned by companies pertain to supply chain gaps such as shortage of components, shortage of lab supplies, and difficulty finding talent locally.

Shortage of components The most common supply chain gap mentioned is the shortage of mechanical and machined components. This is especially the case for small (<20 employees) biomedical companies as they lack volume purchase power and dedicated procurement people. Also mentioned is the challenge of finding suitable contract manufacturing services. Lacking venture funding and in the need of small production runs for clinical trials or focus groups, small companies struggle to find the help of contract manufacturers.

Difficulty finding talent locally Some companies reported the challenge of finding qualified people, especially people for middle skill positions (usually high school or an associate degree). This challenge is partly due to the changing needs of East Bay biomedical companies, as they have transitioned to scaling production. Companies also mentioned that the cost of living has forced people to work further and further from home.

Most companies projected moderate growth over the next year, and a clear trend from the past 10 years of biomedical industry growth in the East Bay is that surviving companies are scaling their production in the East Bay. In terms of companies capturing these opportunities, two themes have emerged:

Integration for Innovation. Biomedical companies frequently stated they kept their manufacturing nearby to integrate it with the rest of their value chain activities. Better integration with and more extensive collaboration between related value chain activities, such as research and development, sales, and marketing, leads to higher flexibility, speed, and responsiveness to customer requirements.

“A strength of our company is our ability to bring everyone together to solve problems and develop new products.”

Right People, Right Skills. Biomedical industry-specific skill needs in the East Bay have changed during the period from 2013 to 2023. While biotechnology, genomics, and digital healthcare were present in the region in 2013, they emerged as the growth leaders by 2023. In addition, as successful biomedical companies have scaled up their production, they have needed a different type of employee, ones focused on operations and production.

Recommendations & Future Opportunities

When asked what industry most needed from regional and local partners, stakeholders shared their top recommendations.

Interactive Supplier Ecosystem Map: An interactive map showing the biomedical companies and their suppliers in the East Bay and in the larger San Francisco Bay Area drew the most enthusiasm. Company representatives noted they would be able to use the map to search for competitors, partners for collaboration, and acquisition or merger targets. People also mentioned the role of the map as a community or ecosystem builder, which will encourage networking and camaraderie.

Local Supplier Search Tool: An online platform for sourcing local suppliers was the most frequently cited need, especially in light of global supply chain shortages. This could address several needs, including a supplier search tool for finding local suppliers, a marketplace for suppliers and service providers, as well as a rating system for helping people with sourcing decisions.

Local Job Board: A job board for finding local talent was a popular tool requested by East Bay biomedical companies. Companies are constantly searching to fill a variety of low to high-skilled positions and finding local talent is likely to be easier, quicker, and less expensive.