Electronics Equipment

Electronics equipment & semiconductor manufacturing in the East Bay has been vital ever since the advent of computers, printed circuit boards, to gaming consoles. These influential products have paved the way for new electronic advancements including robotics, IoT, sensors, autonomous vehicles, and other technologies shaping our everyday lives.

Why the East Bay?

Established Networks

- Legacy supply chains

- Highly-skilled pipeline of talent

- Extensive goods movement infrastructure

- Supportive business climate

- Leadership in technological advancements and industry needs

Centrality of Location

- Central geography connecting industries

- Access to talent – North, South, East, West

- Locating where customers are

- Customers with sophisticated demands

- Ability to innovate and grow with customers

INDUSTRY SUMMARY

Description

Electronics equipment manufacturing in the East Bay is the historical foundation for high technology manufacturing, with a strong reputation for innovation and reinvention.

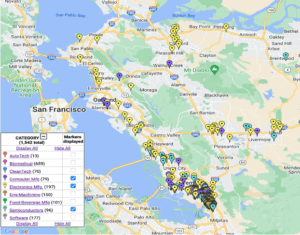

Electronics equipment manufacturing is represented by 373 East Bay companies and includes electronic product manufacturing, such as semiconductors and other electronic components, computer-related products, and navigational/electromedical equipment. Around 95 percent of electronics equipment companies are in Alameda County, especially in Fremont.

The industry is segmented into computer manufacturing, electronics manufacturing, and semiconductors. Around 54 percent of companies are in electronics equipment manufacturing, followed by computers (25 percent ) and semiconductors (21 percent).

Number of Companies in Each Sector, 2023

Fremont is a significant location for this industry. Three quarters of all electronics equipment manufacturers are in Fremont. There is still a strong attraction of Silicon Valley in terms of legacy companies clustering in this area and the high resource concentration. Fremont is not only the gateway to Silicon Valley, but is a strong draw for tech entrepreneurs. Companies opt to locate in Fremont to capitalize on the city’s local legacy supply chain and workforce. Its central geographic location provides access to diversity of talent: the intersection of Central Valley (manufacturing labor), Berkeley (administration staff), and Silicon Valley (engineering talent).

“We are in the middle of that intersection [Tracy, San Jose, Berkeley], in large part to make sure we give a lifestyle balance to our manufacturing, engineering, and administrative staff.”

#2

Region in California

Key Players

Electronics equipment companies in the East Bay include global-leading makers of computers, electronics, and semiconductors as well as smaller companies that make specialized parts for robots, sensors, to electric and autonomous vehicles.

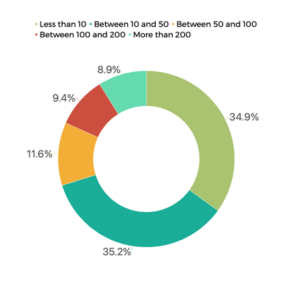

Company Size by Number of Employees, 2023

Company Size by Number of Employees, 2023Companies are building on the legacy of the electronics industry with legacy products, but they are also capitalizing on the innovation happening in the emerging makers of robots, sensors, and electric and autonomous vehicles. The manufacturing process of these sectors are rapidly changing too to include activities that associate with computer technology.

For electronics equipment companies, locating where their customers are and quickly responding to change is crucial if they want to be a part of their customers’ value chains. Local infrastructure allows this access to customers and helps to move components where they are needed faster. In addition, the large pool of local contract manufacturers allows electronics producers to phase out obsolete components and take advantage of the rich East Bay manufacturing environment by leveraging innovation.

On the other hand, the diversity of technological innovation and its applications contributes to the emergence of niche manufacturing, with smaller high-value outputs. The inflow of cheaper electronics components from Asia makes it harder for companies to compete for contracts locally unless their value is customization and flexibility. The electronics startup environment is not as robust as in biomedical or cleantech sectors, but it does provide local resources for early-stage prototyping and production.

Number of Jobs

East Bay electronics equipment manufacturing is the hub connecting business, engineering, and manufacturing talent.

The East Bay labor market is dominated by established electronics equipment companies employing business, engineering, and manufacturing talent. Small companies run by entrepreneurs also compete for talented engineers. Companies have access to engineering and management talent from schools like UC Berkeley. Lifestyle benefits help attracting talent to the region.

High cost of living, however, creates scarcity of manufacturing talent. For commuting workers from the Central Valley, though, Fremont is closer than the South Bay. However, this does not solve the shortage of skilled people to work in operations, e.g., technicians. Ironically, the traditional electronics industry is losing technical talent to emerging sectors that spring out of old industries, e.g., robotics, EVs, sensors.

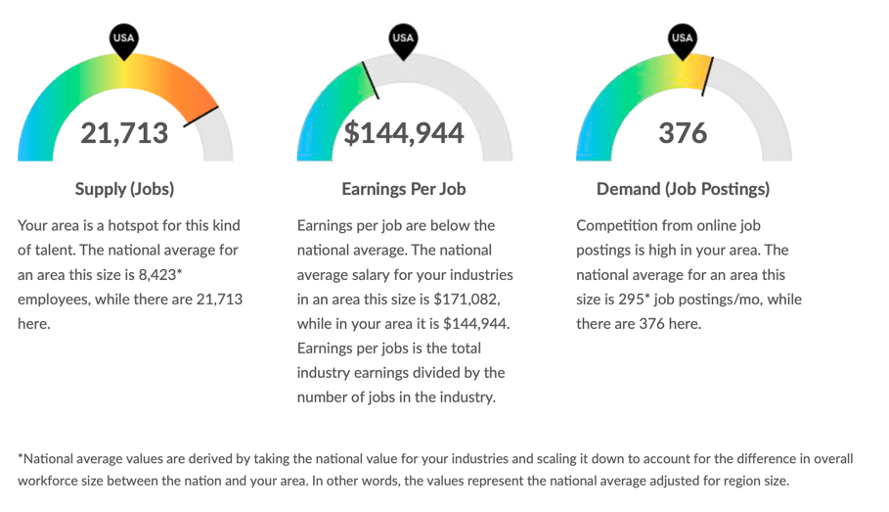

Hiring Competition in Electronics Manufacturing Industry, Alameda and Contra Costa Counties, Lightcast, 2023

The top three skills sets advertised for in job postings are for material handlers, design engineers, and manufacturing engineers. The automotive industry is now also competing for high tech talent in both design and manufacturing since the complexity of electronic components has been changing cars into “computers on wheels.” A heavy skewing of demand towards new product development and computer science is evidence of the intense innovation activities happening across multiple industry sectors beyond the traditional electronics equipment manufacturing.

Hiring Competition in Electronics Manufacturing Industry, Alameda and Contra Costa Counties, Lightcast, 2023

The top three skills sets advertised for in job postings are for material handlers, design engineers, and manufacturing engineers. The automotive industry is now also competing for high tech talent in both design and manufacturing since the complexity of electronic components has been changing cars into “computers on wheels.” A heavy skewing of demand towards new product development and computer science is evidence of the intense innovation activities happening across multiple industry sectors beyond the traditional electronics equipment manufacturing.The market is forecasted to grow at a moderate rate, with the prediction of a mild recession.

Labor market will respond with higher attrition rates which will force companies to be creative in “doing old things new ways” as it comes to talent.

21k

Job supply

Trends and Driving Force

Innovative and nascent products and sectors are emerging from the electronics equipment manufacturing foundation of more mature sectors such as computers, semiconductors, and computer gaming equipment. In addition, there has been a convergence of industries as electronics has fueled growth in the biomedical and cleantech industries.

The nature of the electronics industry globally changes towards regional specialization, forcing East Bay electronics equipment manufacturers to find their own unique positioning in the value chain of the ever-expanding global system. In addition, the emergence of new technology-intense sectors, in part driven by legislation and in part by customers’ sophisticated demands, causes further fragmentation of the industry and the necessity for companies to work in the intersection of several sectors.

The industry witnesses the shift from mainstream tools to highly specialized low-volume niche components. This specialization demands smaller outputs and high customization. Small-scale producers, however, are not privileged by the established systems in terms of transporting and warehousing low-volume niche components. Although companies value the access to freight, freight is expensive and not flexible for smaller manufacturers, especially, with specialized (size and sensitivity) component needs. Companies must be inventive in how they ship and store, thus redrawing the boundaries of the existing ecosystem.

Challenges and Opportunities

In Spring 2023, East Bay EDA convened focus groups and interviews with industry leaders who shared why they’ve chosen to locate and invest in the East Bay, as well the challenges and opportunities facing the industry.

Challenges

Challenges include supply chain dependency on foreign components and shrinking pool of technical talent.

Recent disruption in supply chains demonstrated the East Bay industry’s dependency on foreign components. The resulted “shortage of components” forced companies to work at lower capacity. In general, supply chains have become more expensive because more and more players are trying to tap into the same pool of suppliers. Companies competing at lower volumes are at a disadvantage and must look for sourcing beyond the region. One way companies mitigate this challenge is through automation done by local engineering talent who develop tools for new manufacturing processes.

“We cannot compete with overseas operations. However, we compete by automating.”

With local collages phasing out technical skill training, it is becoming harder to find manufacturing workers. Workforce is a problem, but finding the right people on local job platforms is even a bigger problem since there are few local services dedicated to the local labor supply. People who are born in the US tend to be less interested in manufacturing jobs, especially at the assembler level, and people who are interested in these jobs often do not have the necessary skills.

“What is hurting us is really the resources around recruiting. We go on to national platforms to try and find somebody locally, usually without success.”

Opportunities

In terms of growth projections, companies report slower growth than expected due to labor challenges and supply chain blockages. Most companies, however, aim for 30 percent growth over next year by maximizing current facilities and using their existing footprint.

In terms of companies capturing these opportunities, two themes have emerged:

East Bay electronics companies must remain relevant and nimble as they continue to be the foundation for reinvention. This requires the industry to keep a finger on the pulse of innovation, technologies, and startups as well as to be flexible, streamlined, and ready to adapt. In addition of being informed, companies need to expand interactions and partnerships across multiple sectors, create networks, innovate with their customers, and become trend setters together with partner industries.

“Things change so fast that companies are coming up with new ideas. It would be great to tap into those. Maybe it’s just a conversation. Maybe it turns into a supplier agreement.”

There is a lot of workforce mobility in the region that is not fully harnessed by the electronics industry. The industry must change its recruiting strategies to attract people back to manufacturing jobs. There is an opportunity for companies to be a part of the workforce development process. To solidify and strengthen the pipeline of technical talent, the industry should start working with partners on the city level, connecting with local community colleges, and making careers in manufacturing desirable and accessible.

“We found the local government to be really cooperative and it has worked really well for us.”

Recommendations & Future Opportunities

When asked what industry most needed from regional and local partners, stakeholders shared their top recommendations.

East Bay Concierge: A guide, either virtual or an industry expert, is needed to help electronics equipment companies and their related and supporting partners to navigate changing policies, funding and other resources, procurement opportunities, and news on emerging technologies and companies. This guide would be assisted by a database that would identify local suppliers, contractors, new technologies, and opportunities, such as the recent CHIPS Act or how to access the National Laboratories for procurement or research partnerships. The goal would be to share resources learnings as well as find partnership opportunities.

Pipeline of Talent: To assist electronics equipment companies with their shortage of talent and inefficient connections to educational institutions, a talent search tool would help improve connections to community colleges/trade schools, increase access to internships/apprenticeships, and connect interested people to employment opportunities. Most importantly, this tool would help develop new partnerships and programs with local community colleges and trade schools to train talent and connect people to industry opportunities.

Customized Logistics: Electronics equipment companies, especially small and medium-sized, need help with customized logistics solutions. This could be an online organizing/collaboration platform for helping companies investigate and share customized logistical solutions for shipping small volumes of high-value components.