Food and Beverage

Food and beverage manufacturing has deep roots in the East Bay with access to fresh and year-round produce and ingredients. However, as climate change impacts where, when, and how food is grown, East Bay companies are continuously adapting and utilizing emerging technologies to respond to rapidly evolving changes.

Why locate and manufacture in the East Bay?

Local Innovation

- Value-add legacy manufacturing

- Birthplace of farm-to-table “California Cuisine”

- Access to “food tech” incorporating bioscience and technologies

- Collaborative food & beverage ecosystem

Thriving Food Scene

- Growing consumer demand and “melting pot” of flavors

- Access to food producers in Central Valley and beyond

- Access to fresh, culturally-rich and seasonal ingredients

- Extensive goods movement infrastructure

INDUSTRY SUMMARY

Description

East Bay food and beverage manufacturing industry is a diverse environment with a complex ecosystem in which both legacy companies and startups benefit from local innovations to meet sophisticated local demand.

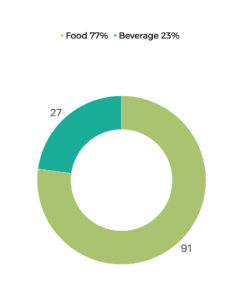

Number of Companies in Each Sector, 2023

Number of Companies in Each Sector, 2023The majority of food and beverage producers are located along the major freeway corridors, I-580, I-680, and I-880. In individual cities, companies cluster in the areas of commercial real estate suitable for production activities of small and medium scale as well as with the access to warehousing. As companies scale up, they are faced with the decision to move within the East Bay or to move out of state. Niche companies emphasizing freshness of their products and in need of quick access to consumers tend to privilege location over economies of scales. Large scale producers are more capital dependent and most likely invest in improvements and retrofits of their current location rather than move to a new one.

A big part of geography is food and beverage companies’ proximity to end consumers. The East Bay is densely populated, which gives food and beverage companies instant access to a large base of customers ranging from consumers of everyday staples like bread to sophisticated foodies and early adopters. Well established logistics and distribution infrastructure and transportation intensity of the region allow companies to get their products to customers faster.

“If we can start early and the innovation begins in the East Bay, then the manufacturing follows.”

470

F&B Manufacturers in the East Bay

Key Players

Although large scale producers are important for the region, it is small and medium-scale food innovators who give the East Bay the special character of being ahead of time on many fronts including what and how to produce, and consume food.

This industry is characterized by many family businesses competing with large scale producers. The industry competitor scene is changing gradually to include food startups working at the intersection with other industries such as biotech and cleantech. The customer base in the East Bay is very diverse, which allows companies to pursue niche strategies, such as the case of lab grown meat. Companies, however, still need to adopt differentiation strategies that put focus on consumers and tell a story that connects companies to consumers.

Traditional food and beverage business models force companies to choose between scaling up or scaling out when it comes to growth in the East Bay. Switching cost to a new location within the region is too high, especially if the output increase is only marginal. In many cases, commercial scaling up requires moving manufacturing out of the East Bay. Companies opt not to scale up in the physical space but rather look for alternative solutions for how to grow within the existing facility. Many still operate at lower capacity than their physical space permits. One scaling up model is not to grow through space but to grow through partners (e.g., looking for new partners/distributors).

The most dynamic sector of food and beverage manufacturing is foodtech. Foodtech startups are working at the intersection of science, technology, and business entrepreneurship. These companies are set to bring a system-based change to the traditional ways of growing, producing, and consuming food. The new concepts of diversification that come out of this entrepreneurial environment include not only food but the entire value chain of the newly emerging bioeconomy.

Number of Jobs

The East Bay labor market for food and beverage manufacturing responds to mild recession with higher attrition rates which forces companies to be creative and start “doing old things new ways” as it comes to talent.

Availability of people is a challenge shared by many in the food and beverage industry. Companies report the lack of both food industry specific skills and general skills. The existing pool of workers expanded to include areas outside the immediate East Bay, such as the Central Valley and the North Bay. Even for out-of-the-region workers, companies compete with big box retailers such as Costco and Amazon. To fill middle skill jobs, food and beverage producers compete with the hightech sector, which pays higher wages and provides company perks.

Among regional advantages of the East Bay labor market are the access to high quality engineers, clustering of robotic and software producers, access to R&D and test facilities, access to food scientists, and local growers who are willing to experiment. In addition, the adjacent service economy creates a bigger pool of professional service providers including financial, legal, and marketing services among others.

The labor market for the East Bay food and beverage industry is characterized by average competition in hiring over average supply of talent. The supply of jobs in two counties, Alameda and Contra Costa, is on par with the national average for the same type of companies. Availability of jobs is also similar to the national average demand for talent, based on online job postings (see below).

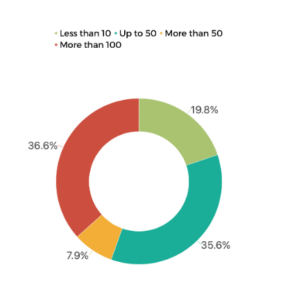

Hiring competition in food and beverage industry, Alameda and Contra Costa Counties, Lightcast, 2023

The demand for skills is segment specific. Both segments, food and beverage, however, offer the jobs that are primarily for people with a high school or two-year degree. The top three skills sets advertised for in job postings are warehousing, manufacturing, and merchandising.

$76k

Earnings per job is the same as the national average.

Trends and Driving Force

For the East Bay food and beverage producers, innovation seems to be the word as it comes to finding new models of operating within the organization as well as in companies’ extended networks.

Current trends include growing consumer pressure for sustainable products and practices, emphasis on health claims on packaging and in marketing, increased food manufacturing automation, rising cost pressure due to supply chain challenges, and evolving workplace quality of life to attract workers. The food and beverage industry in the East Bay, however, is very diverse and not homogeneous enough to make generalized trends true for all without further segmenting it into smaller groups based on micro geographies and/or types of products.

“We spend more on everything – fuel, labor, lawsuits, energy – just trying to be greener.”

High demands are placed on companies in terms of compliance with standards whether they are mandated or self-imposed (ESMG assessments, zero waste, certifications, carbon footprint, etc.). As the expense of operating in the physical world is already high in the East Bay, companies are forced to innovate how to make economics of sustainable practices more attractive. A similar challenge is presented along the entire supply chain – upstream and downstream – by the introduction of regenerative practices and the recent trend of “greening’ of ingredients.

Innovation seems to be the word as it comes to finding new models of operating within the organization as well as in the company’s extended networks. Innovations driven by both final consumers and regulations – in products, processes, and packaging – require collaboration with and education of the partners along the entire supply chain. Looking for and finding a “true” partner within the ecosystem, whether it is in banking, labor training, or the science community, becomes a prerequisite not only for growth but also for mere survival in this industry.

Challenges and Opportunities

In Spring 2023, East Bay EDA convened focus groups and interviews with industry leaders who shared why they’ve chosen to locate and invest in the East Bay, as well the challenges and opportunities facing the industry.

Challenges

The key challenges mentioned by companies are disruption of supply chain, access to property, shortage of labor, and lack of resources for small-scale producers.

“We [are] always looking for new ideas around access to smaller transportation, smaller cold storage, smaller automation equipment.”

Small and medium manufactures tend to move more than larger scale manufacturers unless they have specific property needs (e.g., drainage in the floor in wine making or bay doors tall enough to accommodate holding tanks for beer making). Although the pool of available inventory is large, properties require high capital investment up font to accommodate new manufacturing tenants, which makes their business model less attractive. In addition to being inflexible, lenders tend to give preference to higher paying tech sector tenants, thus keeping rent rates inflated. In general, this sector is characterized by inefficiencies in property use, lack of resource sharing, and inert support system of city governments.

Labor is the hot topic for a lot of companies. Many report the gap in the trade training system that starts with local colleges eliminating courses for developing manufacturing skills. Although the labor pool in the East Bay is large, the food industry specific pool is almost nonexistent. Some jobs are not only industry specific but rather company specific and require training on the job. Companies report high attrition rates which makes onboarding employees more expensive than retaining them. This problem is compounded by the generally high level of labor wages and inability of food and beverage companies to compete for labor with high tech companies.

Small-scale food and beverage producers are less privileged by this economy than national producers. The lack of access to small scale equipment (e.g., weighing, packaging, automation) hinders producers’ abilities to set up sustainable manufacturing. Professional service providers, e.g., architects and construction management, tend to offer solutions designed for larger scale manufacturing. A similar situation is reported with transportation services that become less flexible and efficient and more expensive as producer’s scale becomes smaller. Business incentive programs are not easily available or hard to navigate on the city, state, and federal levels.

Opportunities

The market is forecasted to grow at a moderate rate, with the prediction of a mild recession. Most companies reported moderate to low growth rates. In terms of companies capturing these opportunities, three themes have emerged:

“But being local and buying local is really important, because then when all things are equal, we need that to win.”

Food and beverage companies seem to be best suited to embrace the local revolution due to the deep connection they have to communities they serve. There is a strong element of resilience built in the idea of being local and relying on local networks.

Many companies surveyed have their roots in the East Bay, which is the case across the board – for century-old heritage manufacturers such as Ghirardelli Chocolate as it is for young startups such as Pow.bio. The Bay Area is a very attractive place to live and work; companies exhibit strong commitment to the place and to the communities they serve. In return, companies benefit from local community collaboration efforts and enjoy support systems of the networks.

Local innovation culture in the region is a strong draw for food and beverage companies that benefit from being near hightech industries, universities, science communities, and educated consumers. Food and beverage producers drive the development of the gig-economy as much as they take advantage of its extensive delivery networks. Clustering of mission-driven, like-minded organizations and institutions makes it easy to participate in local sustainability efforts. Industry networks facilitate the flow of ideas and the spread of best practices. The next big innovation challenge reported by companies is finding alternative ways of using resources, be it energy or labor.

“And being able to scale a novel product and develop that process from scratch has been the real fun part of the job in terms of scale.”

Recommendations & Future Opportunities

When asked what industry most needed from regional and local partners, stakeholders shared their top recommendations.

Resource Sharing Database: To leverage existing capacities and increase the systems’ efficiencies, companies want access to the pool of available resources, including a shared inventory of resources, seasonal availability of resources, availability of space, refrigeration, etc.

Access to Sector Specific Labor Pool: In addition to seasonal labor demands, food and beverage companies have a high degree of specialization depending on the sector. A labor specific database can be used for moving people through the network and will help companies with employee mobility and transferability as well as planning in general.

Circular Economy Collaboration: Companies need understanding and promoting circularity principles of a no waste economy. Collaboration along the entire value chain is paramount starting with education about the supply chain, on the industry’s needs, and how it operates in general.